Foreclosure Filings Drop in First 6 Months of 2018

July 24, 2018

The number of U.S. properties with foreclosure filings, default notices, scheduled auctions or bank repossessions dropped during the first six months of 2018, according to a report from ATTOM Data Solutions.

According to ATTOM’s Midyear 2018 U.S. Foreclosure Market Report, there were 362,275 properties with such designations during the first half of the year, down 15 percent from the same period a year ago and down 78 percent from a peak of 1,654,634 in the first six months of 2010.

Only 26 of the 219 metropolitan statistical areas (MSAs) analyzed by ATTOM posted year-over-year increases in foreclosure activity in the first six months of 2018. Those MSAs included Houston (up 10 percent); Dallas-Fort Worth (up 11 percent); Cleveland (up 4 percent); Phoenix (up 5 percent); and Indianapolis (up 2 percent).

“Localized foreclosure flare-ups in the first half of 2018 can no longer be blamed on legacy distress left over from the last housing bubble given that nearly half of all active foreclosures are now tied to loans originated in 2009 or later and given that the average time to foreclose plummeted in the first two quarters of the year,” ATTOM Senior Vice President Daren Blomquist said in a release. “Instead these local foreclosure increases are typically the result of more recent distress triggers in those markets.

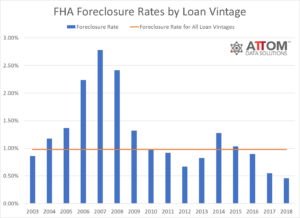

“We’re also seeing early evidence of gradually loosening lending standards starting in 2014, specifically for FHA-backed loans,” Blomquist added. “The foreclosure rate on FHA loans originated in 2014 and 2015 has now jumped above the average FHA foreclosure rate for all loan vintages — the only two post-recession vintages with foreclosure rates above that overall average.”

ATTOM identified the states with the highest foreclosure rates in the first half of 2018 as New Jersey (0.80 percent); Delaware (0.57 percent); Maryland (0.50 percent); Illinois (0.44 percent); and Connecticut (0.40 percent).Other states with first-half 2018 foreclosure rates among the highest were South Carolina (0.39 percent); Ohio (0.37 percent); Nevada (0.37 percent); Florida (0.37 percent); and New Mexico (0.35 percent).

The MSAs with the highest foreclosure rates in the first half of 2018 were Atlantic City (1.48 percent); Trenton, N.J. (0.96 percent); Flint, Mich. (0.95 percent); Philadelphia (0.64 percent); and Columbia, S.C. (0.58 percent), ATTOM found.

The report said 191,914 U.S. properties started the foreclosure process during the first six months of 2018, down 8 percent from the first half of 2017 and down 82 percent from a peak of 1,074,471 in the first half of 2009.

Twenty-two states posted a year-over-year increase in foreclosure starts in the first half of 2018, with Texas (up 11 percent); Michigan (up 5 percent); Arizona (up 1 percent); Indiana (up 51 percent); and Tennessee (up 13 percent) leading the way.

ATTOM said 40 percent of the MSAs analyzed posted year-over-year increases in foreclosure starts in the first half of 2018, including Houston, (up 25 percent); Dallas-Fort Worth (up 17 percent); Las Vegas (up 7 percent); Detroit (up 23 percent); and Minneapolis-St. Paul (up 50 percent).

Forty-five percent of MSAs had second-quarter foreclosure activity above their pre-recession averages, ATTOM found. Those MSAs included New York-Newark-Jersey City (50 percent above); Philadelphia (42 percent above); Washington, D.C. (51 percent above); Boston (19 percent above); and Baltimore (235 percent above).

During the second quarter, properties foreclosures took an average of 720 days from the first public foreclosure notice to complete the foreclosure process, down from 791 days in the previous quarter and down from 883 days in the second quarter of 2017, ATTOM found.

States with the longest average foreclosure time during the second quarter were Hawaii (1,553 days), Florida (1,166 days), New Jersey (1,161 days), Utah (1,108 days), and Indiana (1,054 days).

States with the shortest average foreclosure time during that period were Arkansas (152 days), Virginia (169 days), New Hampshire (177 days), Mississippi (188 days), and Minnesota (222 days).